WTF is BDD?

The Muskification of medical devices.

We’re 🎵 baaaack 🎶. Sorry for the suspense…a lot has happened since we last spoke. Pretend it was a season finale! Previously on You, I & AI…

There was a period in 2024 during which I was thinking about Elon Musk a lot because of this. Now, I’m thinking about Elon Musk for a lot of other reasons. As we’ll discuss, I cannot really avoid thinking about this man.

The Breakthrough Devices Program

The FDA’s Breakthrough Devices Program grants eligible Class III devices “breakthrough device designation” (BDD). BDD is intended to supplant longer pre-approval processes in order to expedite a device to market quickly in cases where proof of therapeutic benefit outweighs a device’s potential risk(s). Essentially, BDD pushes devices in the development pipeline along faster, which (manufacturers know) is basically the Golden Ticket of market approval.

BDD is valuable because, despite the FDA’s 180-day (~5.9-month) statutory deadline to review and decide on the status of medical devices undergoing premarket approval (PMA), Class III (high-risk) medical devices have, on average, taken much longer to make it to market. Yes, revision to the panel meeting process in 2010 reduced the average approval process from 365 days to 243 days, but that’s still 8 months—in an industry where innovation is fast-paced and technological turnover is nearly guaranteed, a three-month backlog is no joke. Still, we’ve seen the FDA grant accelerated approval to products (i.e., drugs) in the past.

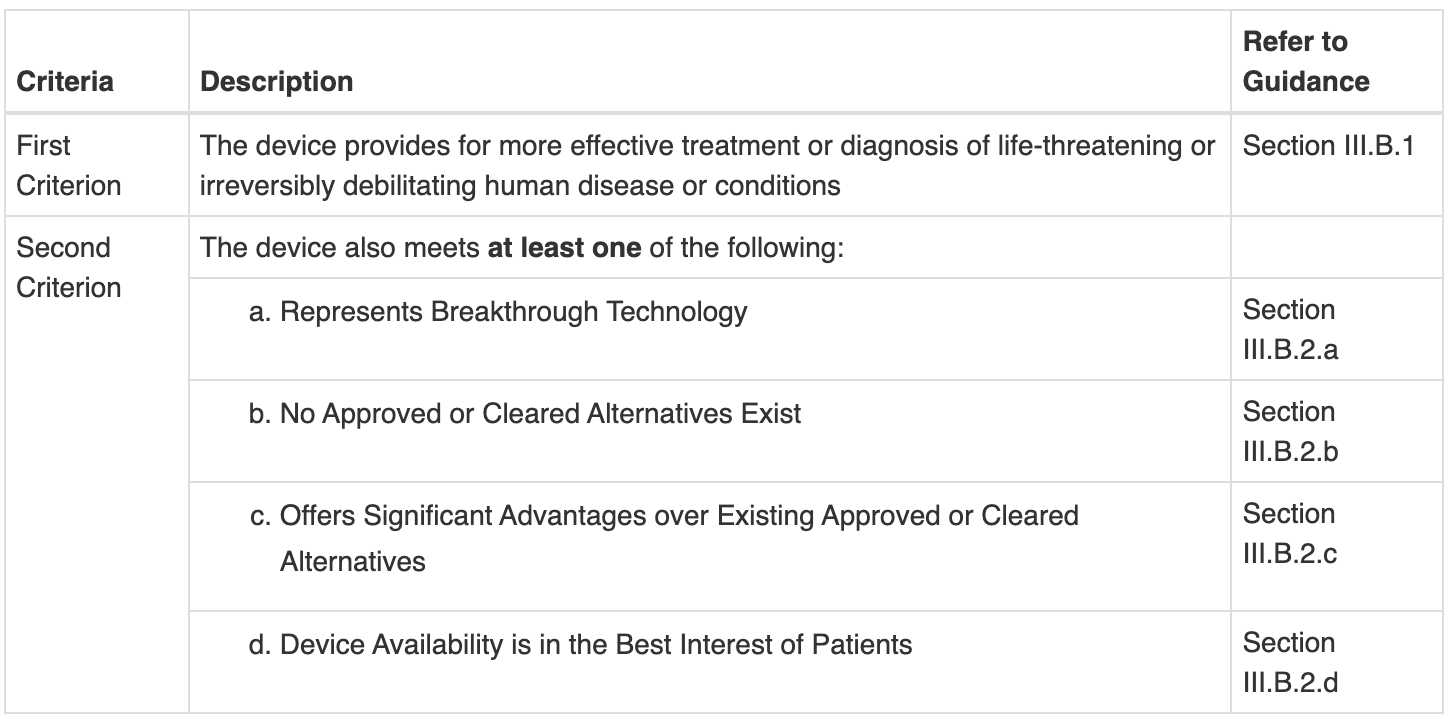

From the FDA’s own website, any device subject to a 510(k), a PMA application, or De Novo classification is eligible for BDD as long as the following criteria are met and your BDD request is submitted before your 510(k)/PMA/De Novo request:

(Your best guess as to what 2(a) means is as good as mine.)

According to the September 2023 Breakthrough Devices Guidance Document:

The Breakthrough Devices Program is a voluntary program for certain medical devices and device-led combination products that provide for more effective treatment or diagnosis of life-threatening or irreversibly debilitating diseases or conditions. The Breakthrough Devices Program may also be applicable to certain devices that benefit populations impacted by health and/or healthcare disparities.

Hold on to that bolded bit.

Neuralink and Blindsight

In September 2024, Elon Musk’s brain-computer interface (BCI) company, Neuralink, was granted BDD for Blindsight, an experimental BCI technology implanted into the visual cortex of the brain to restore vision. Despite this designation, Blindsight isn’t yet considered safe or effective—it still has to go through extensive clinical trials.

Blindsight’s designation came just four months after Neuralink’s wire retraction scandal. While the FDA has declined to comment about the setback, sources have hinted to the fact that the FDA (and Neuralink) both knew about the risk of retraction from animal testing preceding its FDA approval. Regardless, Neuralink deemed the risk too low to merit a redesign, and they were approved for human trials. In the weeks following Neuralink’s first implantation into a human brain, up to 85% of the neural threads had retracted. It should be noted that regardless of the retraction, Noland Arbaugh (Musk’s “Patient Zero”) remained positive and grateful for the intervention, citing a significant improvement in quality of life and faith that Musk and Neuralink would work to resolve any issues before continuing trials. Neuralink stated that the depth of Arbaugh’s implant (3-5 mm) was to blame, upping the distance to 8 mm and—I guess—satisfying the FDA enough to authorize Neuralink to continue patient recruitment.

Did the retraction discussion have any impact on Blindsight’s BDD? Obviously not. But hopefully, Neuralink will proceed with caution during patient recruitment and trials.

Musky business

What’s the bigger picture here? It seems like Noland is happy, Neuralink is doing good work, and the FDA knows what’s up. So, why am I yapping?

As all academics know, the Trump administration’s federal funding freeze has sent medical research into a tailspin. Although this freeze has been lifted for some sectors, universities and other research institutions still face financial uncertainty. For privately funded, multinational companies like Neuralink (whose valuation currently sits around $5 billion USD), the National Institutes of Health (NIH) freeze is pretty inconsequential. But, for Neuralink’s competitors—many of whom are research institutions at American universities producing their own in-house devices—the depletion of federal grants and loans means no development. Period.

I’ll reserve discussion of the anticompetitive American healthcare market for a later date, but the increasing monopoly over medical devices—especially when the founder of the company producing these medical devices is also the head (?) of a governmental organization (?)—is an unprecedented problem.

At the same time, the offensive on DEI and related initiatives is seeing its trickle-down effects on grant submission. Let’s go back to that bolded bit now. On one hand, we’re seeing “buzzwords” identified by the National Science Foundation as flags by which federal funders can reject grants. On the other hand, many of those same buzzwords (see: “disparities”) are embedded throughout the FDA guidance documents required for processes like accelerated approval, De Novo, or BDD. Processes whose benefits are reaped by companies like Neuralink, not by small research firms or academic institutions reliant on federal funding.

In other words, the same criteria that would grant a device BDD are now the criteria that would prevent its R&D.

tl;dr

The FDA has a bajillion approval processes and keeps adding new ways to approve devices faster (sometimes this is good).

Large, private companies know how to go about getting accelerated approvals.

Neuralink has done some good stuff but also some less good stuff.

We are moving into an era of anticompetitive behaviour in device R&D (which is likely to raise existing high healthcare expenditure in the US).

The federal funding freeze directly impacts small firms and research institutes, acting as a barrier to entry in the increasingly monopolistic medical device market.